The aim of a bank reconciliation is to make sure that the bank transactions in Quickbooks match to your bank statements. We would suggest reconciling on a monthly basis if your accounts are complex or at least a quarterly basis if your accounts are quite simple. We’d also suggest doing this before a VAT Return to make sure all the transactions have been included on your VAT return.

Add Transactions

Under ‘Your Books’, click on the ‘Banking’ tab on the left hand side.

Make sure that there are no transactions in the ‘For Review’ section. To do this, you’ll need to:

Add and match sales (sales invoices), click here.

Add and match bills (expense receipts), click here.

Add an match HMRC VAT payments, click here.

For all other transactions that don’t relate to a sales invoice or expense receipt you’ll need to add them directly from the bank feed (& add them as ‘No VAT’):

Received/Spent: Bank interest

Received/Spent: Bank transfer

Received/Spent: Director loan (i.e. loan to company or expense reimbursement)

Spent: Dividends

Spent: Net wages

Spent: HMRC Taxes (e.g. Corporation tax, PAYE/NI)

Balance Check

If the ‘Bank Balance’ and ‘In Quickbooks’ balances match then the bank matches perfectly and you can progress to the ‘Bank reconciliation’ section below.

Account History

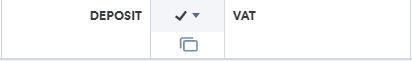

If the ‘Bank Balance’ and ‘In Quickbooks’ balances don’t match, click on ‘Go to Account History’. You’ll then need to sort the transactions by clicking on the tick icon in between the ‘Deposit’ and ‘VAT’ headings.

The transactions that don’t have a ‘C’ or ‘R’ next to them have been added as bank transactions but haven’t been matched to a transaction in the bank. This could be because:

The bank transaction has been added twice (to expense receipts) - you’ll need to delete one if that is the case.

The bank transaction is incorrect - to see if this is the case, click on the transaction, click edit & look at the attachment to make sure that the details added on the expense receipt match the details entered into Quickbooks. If it is different, adjust the values within the transaction.

The bank transaction was paid using a different bank/card - you’ll need to click on the transaction, click edit and change the ‘Bank Account’ to the correct bank/card - it may even be a personal account so you may have to select ‘directors account’

Bank Reconciliation

Click on ‘Go to Account History’ if you’re not already in that section and then click ‘Reconcile’ at the top right of your screen.

You’ll be able to see where the bank was reconciled to and we would suggest reconciling on a monthly or quarterly basis (e.g. if the bank was reconciled up to 31 March last time, reconcile up to 30 April if your accounts are complex or 30 June if your accounts are quite simple).

Enter ‘Ending balance’: £12,345.67, Enter ‘Ending date’: 31.01.2000 & click ‘Start reconciling’.

Your aim is to make the difference at the top right equal 0.00.

First thing to do is tick every transaction to see if the bank reconciles perfectly (i.e. our difference equals 0.00). If it does, a green tick will appear next to the difference - click ‘Finish Now’ at the top right of your screen.

If it doesn’t equal 0.00:

Deselect all transactions

Make sure the ‘Cleared Balance’ matches the last bank statement you reconciled the bank to (e.g. if the last bank statement was 31 March make sure that the balance at the 31 March on your bank statement matches the ‘Cleared Balance’

Then work your way through the bank statement, ticking the bank transactions in Quickbooks and perhaps highlighting it on the physical bank statement. As you tick more transactions within Quickbooks the ‘Cleared Balance’ will change - its important that you make sure that the ‘Cleared Balance’ equals the balance on the bank statement as you work through the transactions

If you find a difference:

You may have duplicates, the transactions may be for the incorrect value or the transactions may have been paid using a different bank/card - go back to the ‘account history’ section above to work out how to resolve these

Items may have been matched incorrectly to an expense that relates to a different period. Go back to the banking tab, click the ‘Reviewed’ tab and click ‘Undo’ next to the transaction that has been matched to the wrong expense

Transactions may be missing - if there are many transactions missing download an excel (.csv) file from your online banking for the period, send it to us and we’ll upload the missing transactions to Quickbooks for you. Alternatively, if its a few transactions you can add them as a bank deposit or expense

There may be an expense dated just before the date your reconciling the bank to that was paid out of the bank just after the date your reconciling the bank to